Featured

Table of Contents

Photo Are enlisted in the California Alternating Rates for Energy (CARE) or Family Members Electric Rate Aid (FERA) program. Have made at least one on-time payment in the past 24 months.

Clients who enroll in the AMP program are not qualified for installment strategies. Internet Energy Metering (NEM), Direct Access (DA), and master metered clients are not currently eligible. For consumers intending on moving within the following 60 days, please relate to AMP after you've developed solution at your brand-new move-in address.

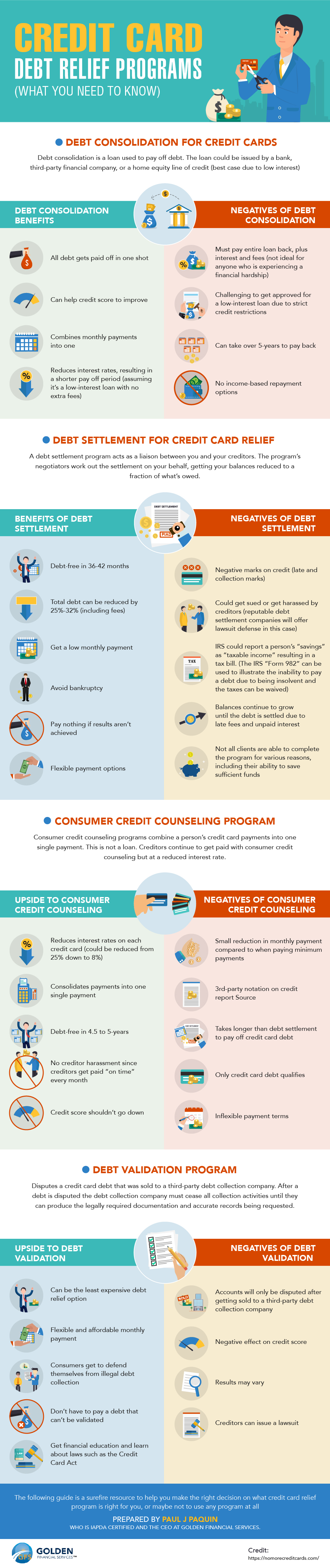

The catch is that nonprofit Bank card Financial obligation Mercy isn't for everyone. To certify, you should not have actually made a payment on your credit rating card account, or accounts, for 120-180 days. Additionally, not all lenders get involved, and it's only used by a couple of not-for-profit credit rating counseling companies. InCharge Financial obligation Solutions is among them.

"The other highlight was the attitude of the therapist that we can get this done. I was really feeling like it had not been going to happen, but she kept with me, and we got it done." The Bank Card Forgiveness Program is for individuals that are thus far behind on credit card repayments that they are in severe monetary problem, possibly encountering bankruptcy, and don't have the income to capture up."The program is particularly made to aid customers whose accounts have actually been billed off," Mostafa Imakhchachen, consumer treatment expert at InCharge Financial obligation Solutions, stated.

Legal Considerations in Understanding Credit Report for Better Financial Health : APFSC - Questions

Creditors that participate have actually agreed with the nonprofit credit history counseling agency to approve 50%-60% of what is owed in repaired monthly repayments over 36 months. The set payments imply you know precisely just how much you'll pay over the repayment period. No rate of interest is billed on the equilibriums during the payoff duration, so the payments and amount owed don't change.

It does show you're taking an active function in lowering your financial debt., your debt rating was already taking a hit.

The company will draw a credit score report to understand what you owe and the degree of your difficulty. If the forgiveness program is the ideal solution, the therapist will send you an arrangement that information the plan, consisting of the amount of the month-to-month settlement.

If you miss a payment, the agreement is squashed, and you have to exit the program. If you assume it's an excellent choice for you, call a therapist at a nonprofit credit rating counseling company like InCharge Debt Solutions, that can address your inquiries and assist you determine if you certify.

7 Easy Facts About Steps for Get Started Now Shown

Due to the fact that the program enables borrowers to opt for much less than what they owe, the lenders that participate want confidence that those that make use of it would not have the ability to pay the full amount. Your credit report card accounts likewise need to be from banks and bank card business that have actually consented to get involved.

If you miss out on a payment that's simply one missed repayment the contract is ended. Your lender(s) will certainly terminate the plan and your equilibrium goes back to the original amount, minus what you've paid while in the program.

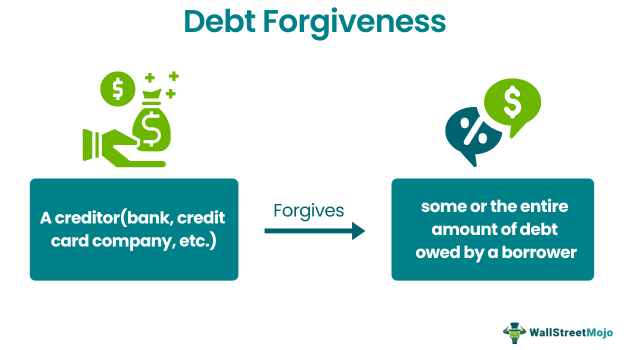

With the mercy program, the financial institution can instead choose to keep your debt on guides and redeem 50%-60% of what they are owed. Nonprofit Bank Card Debt Forgiveness and for-profit financial obligation settlement are similar in that they both provide a method to resolve bank card debt by paying much less than what is owed.

9 Easy Facts About Is Debt Forgiveness Make Sense for Most People Described

Credit card mercy is created to cost the consumer much less, settle the financial obligation quicker, and have fewer disadvantages than its for-profit counterpart. Some vital locations of difference between Charge card Financial debt Forgiveness and for-profit financial debt negotiation are: Credit report Card Financial debt Mercy programs have relationships with lenders that have consented to participate.

Once they do, the payoff duration begins right away. For-profit debt settlement programs negotiate with each financial institution, typically over a 2-3-year duration, while passion, fees and calls from financial obligation enthusiasts proceed. This implies a larger appeal your credit report and credit history, and an enhancing equilibrium till negotiation is completed.

Debt Card Financial obligation Forgiveness clients make 36 equivalent regular monthly payments to remove their financial obligation. For-profit financial debt settlement clients pay into an escrow account over a negotiation duration towards a lump amount that will be paid to financial institutions.

Table of Contents

Latest Posts

8 Easy Facts About The Advantages to Consider When Considering Bankruptcy Described

The 9-Minute Rule for The Value of Licensed Bankruptcy Counselors

Get This Report about Federal Programs for Financial Recovery After Divorce: How Specialty Counseling Helps You Untangle Joint Debt

More

Latest Posts

8 Easy Facts About The Advantages to Consider When Considering Bankruptcy Described

The 9-Minute Rule for The Value of Licensed Bankruptcy Counselors